Trust, Data, and Determination: Niccolò’s Rise in the World of Finance

By Maria Elisa Bizzotto

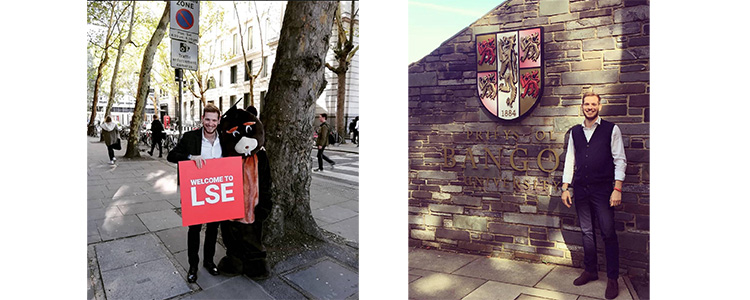

Niccolò Giuliacci is a finance professional currently working at Exor, an investment holding company based in Amsterdam. As a Università Cattolica alumnus, he completed a double-degree programme and a joint pathway in Banking and Finance: a bachelor's degree awarded jointly by Università Cattolica and Bangor University, and a master's degree joint pathway with London School of Economics leading to a degree issued by LSE and one by Università Cattolica. His career, thanks to roles at HSBC, Cassa Depositi e Prestiti and now Exor, gave him experience both as a client and advisor. Through these experiences, he highlights the importance of trust in finance, emphasising transparency and data quality for navigating a data-driven world. He encourages students to believe in themselves and follow their curiosity, reminding them that bold choices can lead to excellence.

The summer before his final year of high school, a student interning at a bank might have admitted that he didn’t have a clear career goal. Driven by curiosity and a willingness to explore, he decided to try out banking and went on to pursue a bachelor's degree in Banking and Finance at Università Cattolica.

The programme at Cattolica strongly focused on banking from the start, which was a driving factor for him. Driven by an insatiable desire to learn, he seized the opportunity to pursue two Double Degree programmes offered by Cattolica: a bachelor's degree jointly awarded with Bangor University in Wales, and a master's degree in partnership with the prestigious London School of Economics.

His ambition was relentless, but it wasn’t easy – he was away from family and friends, his free time was limited, and he was travelling between London and Milan when an internship at HSBC turned into a full-time offer.

However, he has no regrets – the positives far outweighed the negatives: networking with people from around the world, learning to be independent, and improving his English. It is an experience that he recommends to everyone. It changes the way you look at life and the world.

“The biggest challenge was managing myself. For those six years, I didn’t have much free time – but it was something I chose to do. Looking back, I’m very happy with the choices I made. They allowed me to earn four degrees and work for prestigious firms.”

Niccolò Giuliacci, once an intern with doubts, became an international professional in Banking and Finance. This, along with his unwavering determination, led him to land a position at Cassa Depositi e Prestiti in Rome, where he learned the workings of a government-related entity for the first time and the hardships that came with it.

Yearning for a change and a new place to conquer, Niccolò set sail to a new experience at Exor, an investment holding company in the Netherlands. There he focuses on corporate finance and investor relations. The transition to Amsterdam had its personal and professional bumps, but Niccolò’s desire to enjoy this new experience pushed him to never demoralise himself and remember that all negative feelings come to an end.

Niccolò’s diverse experience, working both as client and advisor, is a perspective he considers crucial for a successful career in finance. This has given him valuable insight into the complexity of finance and the importance of trust, one of the most delicate aspects of working with money.

The conversation of “trust” is more relevant than ever in an era where personal data is always being collected and stored by companies, the financial industry in particular, handles sensitive data that requires a higher level of trust. Niccolò emphasises that investors are people first, and people appreciate transparency and trust, alongside open communications; these aspects are key if we want to maintain trust in a data-driven future.

He mentions that while data is essential, its volume can be overwhelming which can lead to confusion. This is why Niccolò, and his current company are prioritising quality information over quantity, and meaningful, transparent data can be key to fostering trust. Trust is also reinforced by regulations set by financial market authorities, whose oversight is widely recognised and respected; the point is to provide information that is clear and useful and not information for the sake of disclosure.

The importance of trust is evident when we look at what happens in its absence. Niccolò points out how banks have collapsed due to a loss of public confidence. Trust is fundamental, and maintaining it requires constant vigilance to avoid actions that could damage credibility.

Data cannot exist without trust: in the data, in those who manage and in those who use it. Trust is needed not only in data collection and processing, but also in oneself when pursuing a career in finance. Had Niccolò not trusted himself, his path might have been very different.

Trusting yourself is Niccolò’s most important advice for young students who are aiming for a career in banking and finance. You’ll hear plenty of opinions, advice, and unwanted comments about your future – but while it’s important to listen, at some point you need to step back, reflect, and make your own decision. Studying is an investment, and you’ll need to capitalise on it eventually and you will do that yourself. Always try to consider studying abroad, do international experience and take the leap – Niccolò can tell you firsthand how those scary leaps can lead to excellence.

Niccolò’s story is like a road with different exits that each have their own uniqueness and flair about them, through his international mobility he has become a well-rounded professional and developed valuable personal skills that he implements in his work every day.